Tikehau 2027 F-Acc-EUR

FR0013505484

Tikehau 2027 F-Acc-EUR/ FR0013505484 /

| NAV2024-07-18 |

Chg.+0.0600 |

Type of yield |

Investment Focus |

Investment company |

| 116.5500EUR |

+0.05% |

reinvestment |

Bonds

Worldwide

|

Tikehau IM ▶ |

Investment strategy

The objective of the Fund is to achieve an annualised performance of greater than 3.6% after deduction of charges over an investment period of at least 5 years. The Fund is to be dissolved or merged on 31 December 2027. Depending on market conditions, the Management Company may also liquidate or merge the Fund before the maturity date of 31 December 2027. This objective is based on the market assumptions made by the Management Company and takes account of the default risk and expenses, including hedging costs. Investors" attention is drawn to the fact that, in the event of an unfavourable change in conditions, in particular in the case of default, the performance target may not be met.

The investment strategy consists of active and discretionary management of a portfolio primarily made up of bonds with a residual maturity at 31 December 2027 of less than or equal to six months, as well as commercial paper and medium-term notes. This objective may not be achieved in the event of default or if later reinvestments do not generate this level of return. The Fund can invest up to 100% of its net assets in high-yield speculative-grade debt securities, or in securities rated investment grade (with credit risk but also a lower yield), issued by private or public sector companies, with no restrictions in terms of geographical region or business sector. The primary objective is to receive the income generated by the portfolio and seek to optimise it via derivative instruments (financial contracts), notably by entering into interest rate swaps. These instruments will also be used to partially or fully hedge against currency risk, with nevertheless a currency risk of a maximum of 10% of net assets. The Fund may use derivatives up to 100% of its net assets (resulting in a maximum total exposure to interest rate products of 200% of its net assets). The Fund can invest (i) up to 20% of net assets in high yield securities rated below CCC+ on their acquisition date (according to the analysis by the Management Company, independent of the rating given by the rating agencies), it being specified that this percentage can be increased to 25% of net assets in the event of a downgrade of the ratings of securities already in the portfolio, (ii) up to 25% of net assets in subordinated financial bonds, including contingent convertibles (CoCos). The Management Company can make trades, in the event of new market opportunities or identification of a rise in the risk of default of one of the issuers in the portfolio. The Fund may also invest up to 10% of its net assets in French or foreign UCIs and/or in foreign investment funds (including those managed by the Management Company). Risk exposure to the equity market may represent up to 10% of the Fund"s assets. The range of modified duration will lie between -2 and 8. Recommended investment period: this Fund may not be suitable for investors wishing to withdraw their investment before the recommended investment horizon of 5 years, bearing in mind that the Fund is to be dissolved or merged on 31 December 2027.

Investment goal

The objective of the Fund is to achieve an annualised performance of greater than 3.6% after deduction of charges over an investment period of at least 5 years. The Fund is to be dissolved or merged on 31 December 2027. Depending on market conditions, the Management Company may also liquidate or merge the Fund before the maturity date of 31 December 2027. This objective is based on the market assumptions made by the Management Company and takes account of the default risk and expenses, including hedging costs. Investors" attention is drawn to the fact that, in the event of an unfavourable change in conditions, in particular in the case of default, the performance target may not be met.

Master data

| Type of yield: |

reinvestment |

| Funds Category: |

Bonds |

| Region: |

Worldwide |

| Branch: |

Bonds: Mixed |

| Benchmark: |

- |

| Business year start: |

07-01 |

| Last Distribution: |

- |

| Depository bank: |

CACEIS Bank |

| Fund domicile: |

France |

| Distribution permission: |

Switzerland |

| Fund manager: |

- |

| Fund volume: |

1.02 bill.

EUR

|

| Launch date: |

2020-03-24 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

3.00% |

| Max. Administration Fee: |

0.75% |

| Minimum investment: |

100.00 EUR |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Key Investor Information: |

- |

Investment company

| Funds company: |

Tikehau IM |

| Address: |

32 rue de Monceau, 75008, Paris |

| Country: |

France |

| Internet: |

www.tikehaucapital.com

|

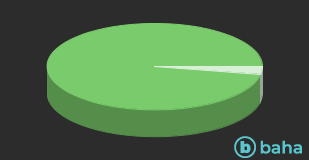

Assets

| Bonds |

|

97.20% |

| Cash and Other Assets |

|

2.80% |

Countries

| France |

|

16.00% |

| Italy |

|

14.30% |

| United Kingdom |

|

10.90% |

| Germany |

|

9.40% |

| Spain |

|

8.20% |

| Netherlands |

|

7.50% |

| United States of America |

|

5.10% |

| Ireland |

|

4.70% |

| Portugal |

|

3.20% |

| Sweden |

|

3.00% |

| Poland |

|

2.90% |

| Austria |

|

2.00% |

| Iceland |

|

2.00% |

| Denmark |

|

1.40% |

| Greece |

|

1.30% |

| Others |

|

8.10% |