Principal GIF Gl.Prop.Sec.A Acc USD

IE00B62KPK41

Principal GIF Gl.Prop.Sec.A Acc USD/ IE00B62KPK41 /

| NAV31/10/2024 |

Diferencia-0.1800 |

Tipo de beneficio |

Enfoque de la inversión |

Sociedad de fondos |

| 10.9600USD |

-1.62% |

reinvestment |

Real Estate

Worldwide

|

Principal Gl.Inv. IE ▶ |

Estrategia de inversión

The objective of the Fund is to seek to provide a total return primarily through investment in a portfolio of global property securities.

The Fund will seek to achieve its objective by investing primarily in a global portfolio of publicly traded securities of companies engaged in the property industry or whose value is largely derived from property assets. The Fund's investment universe will include real estate investment trusts ("REITs") or non-REIT real estate companies in the United States, and similar structures in other areas of the world. The Fund is actively managed with reference to FTSE EPRA NAREIT Developed Index NTR (the "Index") on the basis that the Fund seeks to outperform the Index.

Objetivo de inversión

The objective of the Fund is to seek to provide a total return primarily through investment in a portfolio of global property securities.

Datos maestros

| Tipo de beneficio: |

reinvestment |

| Categoría de fondos: |

Real Estate |

| Región: |

Worldwide |

| Sucursal: |

Real Estate Fund/Equity |

| Punto de referencia: |

FTSE EPRA NAREIT Developed NTR Index |

| Inicio del año fiscal: |

01/10 |

| Última distribución: |

- |

| Banco depositario: |

The Bank of New York Mellon SA/NV |

| País de origen: |

Ireland |

| Permiso de distribución: |

Austria, Germany, Switzerland |

| Gestor de fondo: |

Kelly Rush, Anthony Kenkel, Simon Hedger |

| Volumen de fondo: |

430.06 millones

USD

|

| Fecha de fundación: |

14/02/2020 |

| Enfoque de la inversión: |

- |

Condiciones

| Recargo de emisión: |

5.00% |

| Max. Comisión de administración: |

1.60% |

| Inversión mínima: |

1,000.00 USD |

| Deposit fees: |

- |

| Cargo por amortización: |

0.00% |

| Prospecto simplificado: |

Descargar (Versión para imprimir) |

Sociedad de fondos

| Fondos de empresa: |

Principal Gl.Inv. IE |

| Dirección: |

1 Wood Street, EC2V 7JB, London |

| País: |

United Kingdom |

| Internet: |

www.principalglobal.com

|

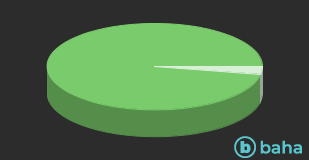

Activos

| Real Estate |

|

97.20% |

| Cash |

|

2.80% |

Países

| United States of America |

|

62.30% |

| Continental Europe |

|

8.70% |

| Japan |

|

8.50% |

| Australia |

|

6.00% |

| United Kingdom |

|

4.40% |

| Hong Kong, SAR of China |

|

2.90% |

| Cash |

|

2.80% |

| Singapore |

|

2.50% |

| Canada |

|

1.90% |

Sucursales

| Industry |

|

21.40% |

| Wohnung und Haus |

|

19.10% |

| various sectors |

|

13.90% |

| Healthcare |

|

13.00% |

| Retail |

|

7.20% |

| Consumer goods |

|

5.70% |

| Cash |

|

2.80% |

| Otros |

|

16.90% |